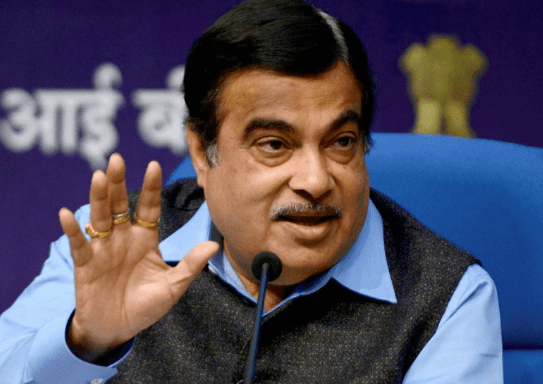

Union Transport Minister Nitin Gadkari confirmed on Tuesday that the Centre has not proposed imposing an additional 10% tax on diesel engine vehicle, as reported in the media. According to sources, Gadkari will write a letter to Union Finance Minister Nirmala Sitharaman today evening recommending the additional tax in an effort to curb pollution.

Nitin Gadkari, Union Transport Minister Said:

“There is an urgent need to clarify media reports claiming an additional 10% tax on diesel engine vehicle sales.” “It is critical to emphasize that no such proposal is currently being actively considered by the government,” Gadkari wrote on X, formerly known as Twitter.”It is imperative to actively embrace cleaner and greener alternative fuels, in line with our commitments to achieve Carbon Net Zero by 2070 and to reduce air pollution levels caused by hazardous fuels like diesel, as well as the rapid growth in automobile sales,” he added. These fuels should be cost-effective, indigenous, and pollution-free import alternatives.”

Gadkari, speaking at the 63rd Annual SIAM Convention in the national capital on Tuesday, referred to diesel as a “hazardous” fuel and stated that the government must import the fuel to meet demand, according to news agency PTI. He also advised the industry to prioritize environmentally friendly alternative fuels such as ethanol and green hydrogen.According to Gadkari, the contribution of diesel cars in the country has already decreased significantly. Earlier this month, a government panel suggested that diesel-powered four-wheeler vehicles be phased out by 2027 in favor of electric and gas-powered cars.

“By 2030, no non-electric city buses shall be added…Diesel buses for city transportation should be phased out beginning in 2024, according to a panel study posted on the oil ministry’s website.

Meanwhile, carmakers such as Maruti Suzuki India and Honda have already stopped producing diesel vehicles.

Notably, autos are currently taxed at 28 percent GST, with additional cess ranging from 1% to 22% depending on the kind of vehicle; SUVs have the highest GST rate of 28 percent, with a compensating cess of 22%.

Get In Touch

Contact Us

New Business