Application for GST Refund

Any person claiming refund of any tax and interest, if any, paid on such tax may make an application before the expiry of 2 years from the relevant date. A taxable person may claim gst refund of any unutilized input tax credit of tax paid on exports or in cases where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on outputs.

Situations where GST Refund would rise

Excess payment of tax due to mistake or inadvertence.

Export (including deemed export) of goods / services under claim of rebate or Refund of accumulated input credit of duty / tax when goods / services are exported.

Finalization of provisional assessment.

Refund of Pre – deposit for filing appeal including refund arising in pursuance of an appellate authority’s order (when the appeal is decided in favour of the appellant).

Payment of duty / tax during investigation but no/ less liability arises at the time of finalization of investigation / adjudication.

Refund of tax payment on purchases made by Embassies or UN bodies.

Credit accumulation due to output being tax exempt or nil-rated.

Credit accumulation due to inverted duty structure i.e. due to tax rate differential between output and inputs.

Year-end or volume based incentives provided by the supplier through credit notes.

Tax Refund for International Tourists.

Supporting Documents Required

Copy of return evidencing payment of duty.

Copy of invoices (in original). The applicant for refund in such cases would submit the copies of the invoices or a statement containing details of quantity along with the refund application.

Documents evidencing that the tax burden has not been passed on to the buyer.

A Chartered Accountant’s Certificate certifying the fact of non-passing of the GST burden by the taxpayer, being claimed as refund should be called for.

Any other document as prescribed by the refund sanctioning authority.

Interest on Refunds

Refund shall be sanctioned in 90 days in all cases, excepting in a case where the refund to the extent of 80% of the total amount claimed is refundable to certain categories of exporters. If refund is not sanctioned within the period of three months, interest will have to be paid by the department.

How will the refunds arising out of earlier law be paid?

The refund arising out of earlier law will be paid as per the earlier law and will be paid in cash (under CGST) or as per the provisions of the earlier law (under SGST) and will not be available as ITC.

Cases in which no refund shall be granted

-

If the registered dealer has not submitted return(s), till he files the return(s).

-

If the registered taxable person is required to pay any tax, interest or penalty which has not been stayed by the appellate authority/Tribunal/court, till he pays such tax interest or penalty; [The proper officer can also deduct unpaid taxes if any of the dealer from the refundable amount].

-

Commissioner/Board can withhold refund, if, the Order of Refund is under appeal and he is of the opinion that grant of such refund will adversely affect revenue.

Refund Processing

- Applicant may be given the option of filing refund application either through the GSTN portal or through the respective State / Central Tax portal. Filing through GSTN portal may be beneficial for those applicants whose refund relates to CGST / IGST as well as SGST or the refund arises in different State Tax jurisdictions. Instead of filing applications with different tax authorities, the same may be filed with the GSTN portal which will forward it to the respective tax authority.

- On filing of the electronic application, a receipt/ acknowledgement number may be generated and communicated to the applicant via SMS and email for future reference. A provision may be made to display the application for refund in dealer’s online dashboard when he logs into the system.

- The “carry forward input tax credit” in the return and the cash ledger should get reduced automatically, if the application is filed at GSTN portal itself. In case the application is filed at the tax department portal, suitable integration of that portal with GSTN portal should be established to reduce/block the amount before taking up the refund processing.

- It should be clearly mentioned / highlighted that generation of this number does not in any way affirm the legality, correctness or completeness of the refund application.

Get In Touch

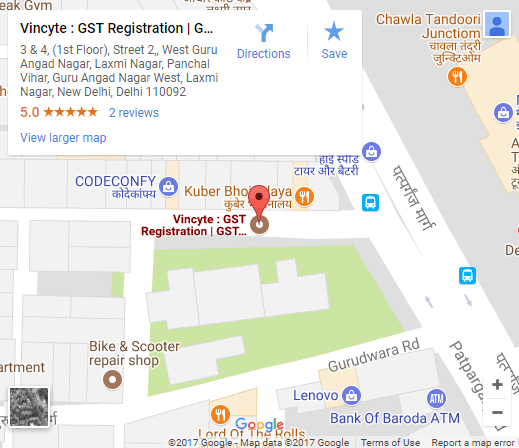

Contact Us

New Business