ESI Returns

[/et_pb_text][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”left” text_font_size=”16″ text_letter_spacing=”1px” use_border_color=”off” border_color=”#ffffff” border_style=”solid”]The Scheme has been extended to shops, hotels, and restaurants, cinemas including preview theatres, road-motor transport undertakings and newspaper establishments employing 20 or more person. This Scheme is alo applicable to non-seasonal factories employing 10 or more person.

ESI scheme is applicable to all the states except Manipur, Sikkim, Aunachal Pradesh and Mizoram.

E.S.I.C is also Statutory Deduction from employee whose GROSS salary is less than or equal to Rs. 15,000/-. If company has below 20 employees in E.S.I.C Purview Company is not liable to pay E.S.I.C.

E.S.I.C is calculated on Gross Salary of Employee @ 1.75% as Employee contribution and 4.75% of Employer Contribution there by totalling to 6.5% of Gross Salary.

[/et_pb_text]

Due Dates

[/et_pb_text][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” text_font_size=”16″ text_letter_spacing=”1px”]The Company needs to file Half Yearly Returns for the period:

[/et_pb_text][et_pb_blurb admin_label=”bullet” url_new_window=”off” use_icon=”off” icon_color=”#662d91″ use_circle=”off” circle_color=”#662d91″ use_circle_border=”off” circle_border_color=”#662d91″ image=”http://vincyte.com/wp-content/uploads/2016/09/bullet.png” icon_placement=”left” animation=”top” background_layout=”light” text_orientation=”left” max_width=”16px” use_icon_font_size=”off” use_border_color=”off” border_color=”#ffffff” border_style=”solid” saved_tabs=”all” title=”1st April to 30 September and”][/et_pb_blurb][et_pb_blurb admin_label=”bullet” url_new_window=”off” use_icon=”off” icon_color=”#662d91″ use_circle=”off” circle_color=”#662d91″ use_circle_border=”off” circle_border_color=”#662d91″ image=”http://vincyte.com/wp-content/uploads/2016/09/bullet.png” icon_placement=”left” animation=”top” background_layout=”light” text_orientation=”left” max_width=”16px” use_icon_font_size=”off” use_border_color=”off” border_color=”#ffffff” border_style=”solid” saved_tabs=”all” title=”1st October to 31st March”]

[/et_pb_blurb][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid” text_font_size=”16″ text_letter_spacing=”1px”]

There is no monthly Returns for ESIC. Employer must pay the ESIC amounts every month on 15th (with grace by 25th).

In case any employees cross the limit of Rs. 7500/- of Gross Salary, he must continue to pay till the end of half year.

E.S.I.C half Yearly Returns submission / due dates are; November 15th and May 15.

[/et_pb_text]

Get In Touch

[/et_pb_text]

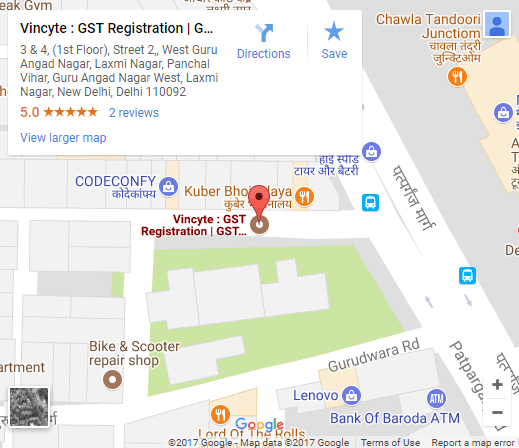

Vincyte

[/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Request for Quote [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Contact Us [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] FAQs [/et_pb_text]New Business

[/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"]Public Company Registration Service

[/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"]Private Company Registration Process

[/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] One Person Company Registration [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Sole Proprietorship Firm [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Foreign Company Registration [/et_pb_text][et_pb_divider admin_label="Divider" color="#ffffff" show_divider="off" divider_style="solid" divider_position="top" hide_on_mobile="on" height="20"] [/et_pb_divider][et_pb_text admin_label="head" background_layout="light" text_orientation="left" text_font="Ubuntu|on|||" text_text_color="#662992" use_border_color="off" border_color="#ffffff" border_style="solid"] NGO [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Section 8 Company [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Society Registration Service [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Trust Registration Service [/et_pb_text]Trademark Registration Service

[/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Copyright Registration Service [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Patent Registration Service [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] ISO Certification Service [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] VAT/Sale Tax Registration [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Service Tax Registration Service [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Excise Registration Service [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Import Export Code or IEC [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] [/et_pb_text][et_pb_text admin_label="Sub head" background_layout="light" text_orientation="left" text_text_color="#000000" use_border_color="off" border_color="#ffffff" border_style="solid"] Factory License Service [/et_pb_text]