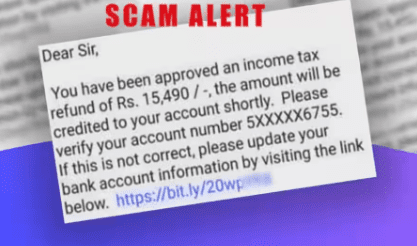

Tax refund scam messages are circulating in India following the July deadline for filing income tax returns.

Income tax refund: If you have received notification that an income tax refund in the amount of ₹XXXXX has been granted and you need to verify or change your bank account. Beware! This is a bogus communication; please do not respond to any such messages.

However, the Income Tax department can never give a link for a refund or they don’t want any bank account confirmation and the Refund is only send after the ITR is processed by the Income Tax Department.

If the ITR is not processed and the tax agency requires additional information, an email is sent to the taxpayers’ registered email addresses. “Scammers are tricking taxpayers into updating their bank account information through fraudulent links,” the PIB Fact Check team said. Be cautious when exchanging sensitive information, and always confirm the validity of messages before acting on your income tax returns.”

Furthermore, never give any debit or credit card information on websites to which you are sent a link via SMS, since this could be a phishing scam designed to steal your card information.

“If you receive an e-mail or find a website that you believe is impersonating the Income Tax Department, forward the e-mail or website URL to [email protected].” A copy should also be sent to [email protected]. You may forward the message as received or include the e-mail’s Internet header. The Internet header contains additional information that will assist us in locating the sender. Delete the message after forwarding the e-mail or header information to us.”

Note:

The Income Tax Department does not ask for specific personal information by email. The Income Tax Department does not send e-mails asking your credit card, bank, or other financial account PIN numbers, passwords, or similar access details.

Get In Touch

Contact Us

New Business