New DRC-01C under GST-for Mismatch in ITC in GST return.

Notification No. 38/2023 – Central Tax

Download 34/2023- Central Tax Dated 4th August, 2023

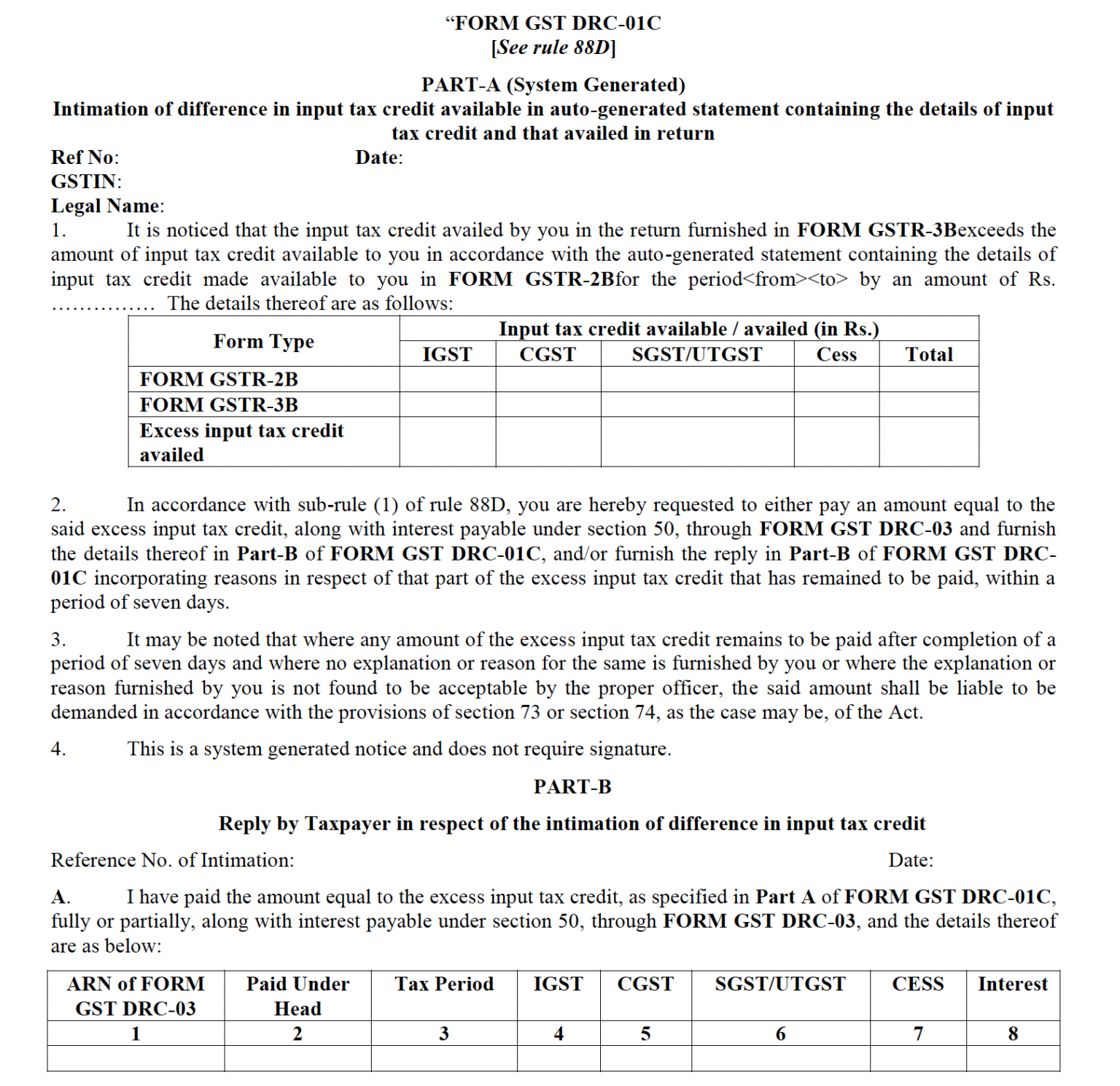

88D. Manner of dealing with difference in ITC available in auto-generated statement containing the details of ITC and that availed in return:

- Where the amount of ITC availed by a registered person in the return for a tax period or periods furnished by the taxpayer in FORM GSTR-3B exceeds the ITC available to such taxpayer in accordance with the auto-generated statement containing the details of ITC in FORM GSTR-2B in respect of the said tax period or periods, as the case may be, by such amount and such percentage, as may be recommended by the Council, the said registered person shall be intimated of such difference in Part A of FORM GST DRC-01C, electronically in GST common portal, and a copy of such intimation shall also be sent to taxpayer e-mail address, highlighting the said difference and directing him to-

- Pay an amount equal to the excess ITC availed in the said FORM GSTR-3B, along with interest payable under section 50, through FORM GST DRC-03, or

- Explain the reasons for the aforesaid difference in ITC on the common portal,

Within a period of seven days:

2. The registered person referred to sub-rule (1) shall, upon receipt of the intimation referred to in the said sub-rule, either,

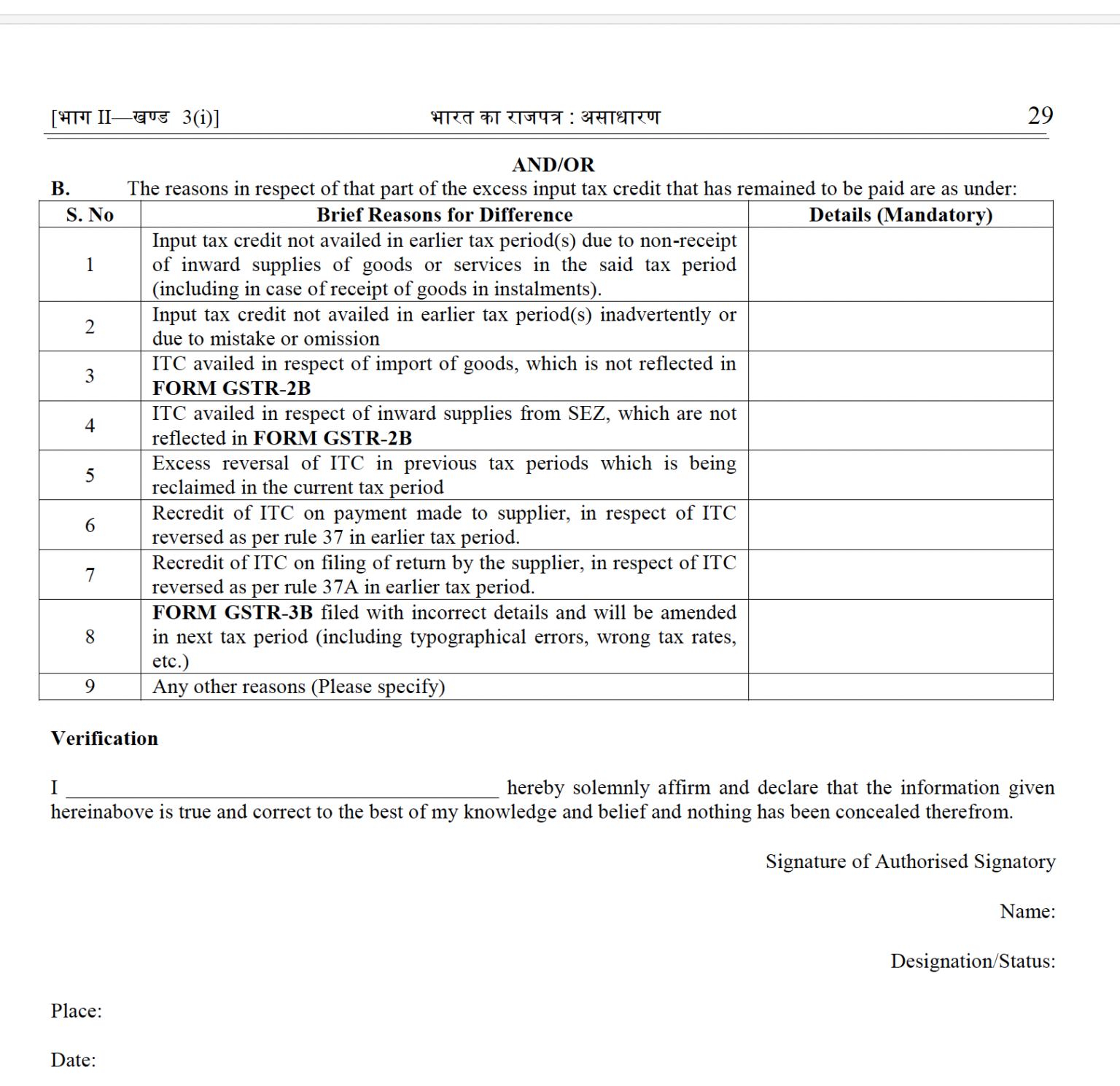

- pay an amount equal to the excess ITC, as specified in Part A of FORM GST DRC-01C, fully or partially, along with interest payable under section 50, through FORM GST DRC-03 and furnish the details thereof in Part B of FORM GST DRC-01C, electronically on the common portal, or

- Furnish a reply, electronically on the common portal, including reason in respect of the amount of excess ITC credit.

Within the period specified in the said sub-rule:

3. Where any amount specified in the intimation referred to in sub-rule (1) remains to be paid within the period specified in the said sub-rule and where no explanation or reason is furnished by the registered person in default or where the explanation or reason furnished by such person is not found to be acceptable by the proper officer, the said amount shall be liable to be demanded in accordance with the provision of section 73 or section 74, as the case may be.

Change in Rule 59(6): Blocking of GSTR-1/IFF of subsequent Period in case of non -compliance of Rule 88D

In the said rules, in rule 59, in sub-rule (6), after clause (d), the following clauses shall be inserted, namely:-

A registered person, to whom an intimation has been issued on the common portal under the provisions of sub-rule (1) of rule 88D in respect of a tax period or periods, shall not be allowed to furnish the details of outward supplies of goods or services or both under section 37 in FORM GSTR-1 or using the invoice furnishing facility for a subsequent tax period, unless he has either paid the amount equal to the excess ITC as specified in the said intimation or has furnished a reply explaining the reasons in respect of the amount of excess ITC that still remains to be paid, as required under the provisions of sub-rule (2) of rule 88D;

Get In Touch

Contact Us

New Business